MINRETA Research Institute

We build that relationship with customers through trust, fairness, respect, honor, innovation, and harmony serving beyond expectations and satisfaction.

Philippines Politics and Economics, Industry, and Global Situation

Source: Explore S&P Global Market

Philippines on Track to Become One Trillion Dollar Economy by 2033

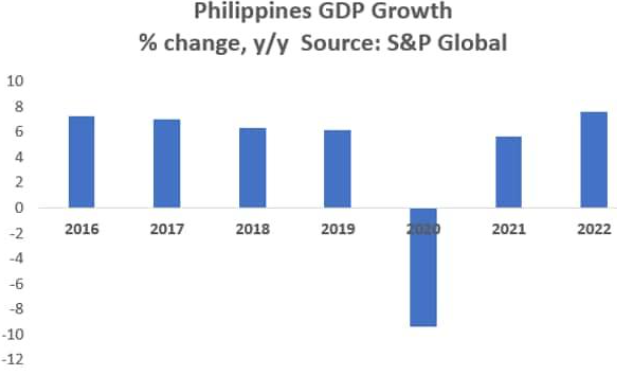

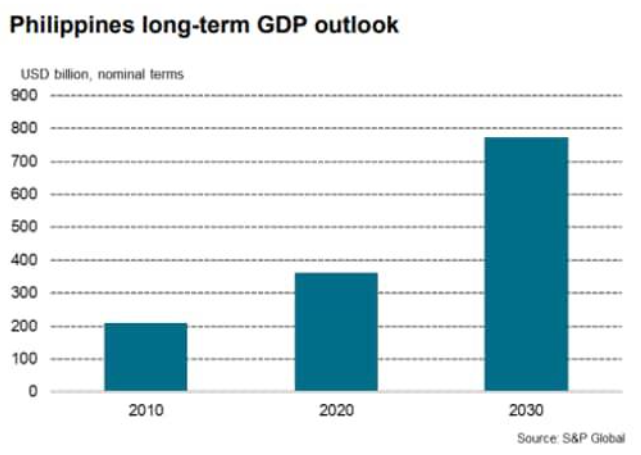

The Philippines economy grew at a pace of 7.6% in 2022, the fastest rate of economic growth recorded by the Philippines since 1976. With strong growth forecast over the medium-term outlook, the size of Philippines GDP measured in US Dollar nominal terms is set to reach USD one trillion by 2033.

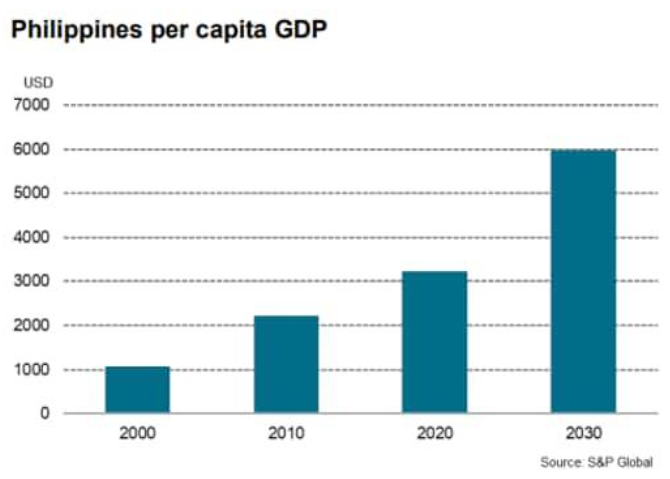

This will make the Philippines one of the largest emerging markets in the Asia-Pacific as well as a leading emerging market globally. Average annual GDP per person has also risen dramatically over the past two decades, from below USD 1,000 per person in 2000 to USD 3,500 by 2022 and is projected to rise above USD 6,000 per person by 2030.

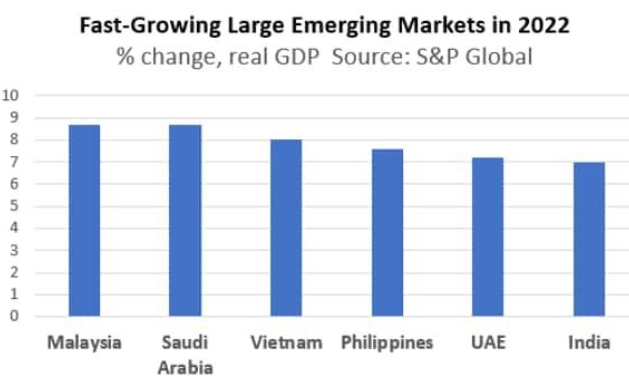

Philippines: One of World's Fastest Growing Emerging Markets

The strong rebound from the COVID-19 pandemic during 2022 helped to drive the pace of growth of the Philippines economy to the fastest rate since 1976. The Philippines GDP growth rate of 7.6% was comparable to some of the world’s fastest growing large emerging markets in 2022, including the Gulf Co-operation Council oil exporting nations of Saudi Arabia and United Arab Emirates, as well as other rapidly growing Asian emerging economies such as Malaysia, Vietnam and India.

The Philippines has also shown a much-improved economic growth performance over the past decade, apart from during the peak period of the COVID-19 pandemic during 2020-21 when there was widespread global disruption to economic activity. During the period from 2012 to 2019, real GDP growth in the Philippines each year ranged between 6% to 7%. The economic rebound in 2022 pushed real economic growth to the highest pace recorded since 1976, with household final consumption expenditure growing by 8.3% y/y while gross capital formation grew by 16.8% y/y.

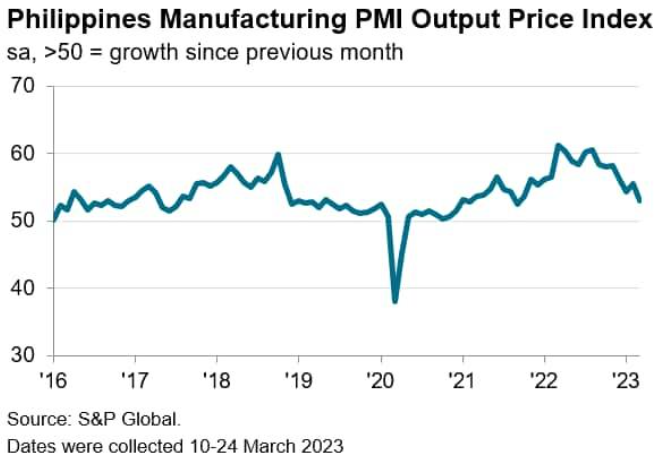

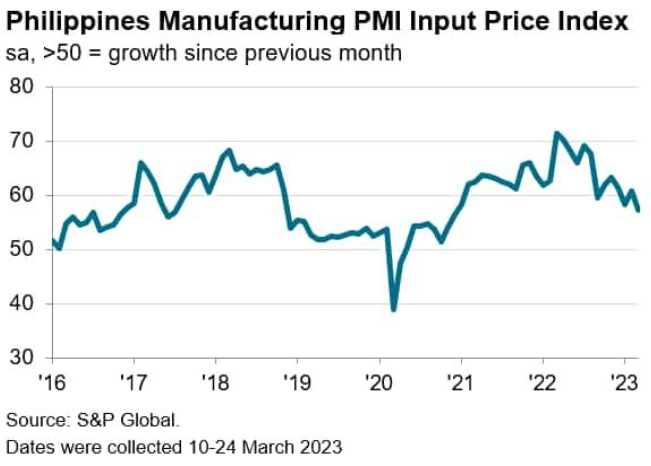

However, supplier performance worsened further, as port congestion and material shortages meant a further lengthening of lead times. Delivery delays, in part, also resulted in a fresh rise in the levels of unfinished work.

Deteriorating Current Account Deficit

Merchandise exports continued to record moderate expansion in 2022, rising by 5.6% y/y. The Philippines export sector showed resilience to the impact of the slowdown in mainland China, which is a key export market. Although exports to mainland China fell by 5.1% y/y in 2022, exports to a number of other key markets rose. Exports to the US were up by 4.2% y/y while exports to Singapore rose by 17% y/y and exports to South Korea rose by 21.5% y/y.

However, exports of electronics products, which comprises the largest share of the total merchandise exports of the Philippines at around 56% of the total, have weakened during the second half of 2022 as electronics demand in key export markets has slowed. In December 2022, exports of electronics products fell by 13.9% y/y, with semiconductors exports declining by 12.8% y/y.

However, imports have shown even more rapid growth, rising by 17.3% y/y in 2022, reflecting sharply higher imports of energy products due to higher world prices for oil and gas. Consequently, the trade deficit for 2022 rose to USD 58.3 billion, compared with USD 37.1 billion in the same period of 2021.

The transmission effects from weaker growth in the US and Western Europe are a vulnerability for the Philippines export sector in 2023, but the rebound in economic growth in mainland China is expected to help to mitigate these effects.

In 2020, the current account surplus reached a record high of USD 11.6 billion or 3.2% of GDP, boosted by the sharp slump in imports due to the severe contraction in domestic demand. However, the current account shifted back to a deficit of USD 5.9 billion in 2021, or 1.5% of GDP, as growth recovery triggered higher domestic demand and rising imports.

Imports soared during 2022, with surging prices for world oil and gas being an important factor contributing to a further sharp deterioration in the current account balance for calendar 2022. The current account for 2022 was in deficit of USD 17.8 billion or 4.4% of GDP due to a widening trade deficit, as the economic recovery and rising oil prices pushed up imports.

External debt as a share of GDP remains moderate, at an estimated 26.8% of GDP in September 2022, according to BSP data.

An important stabilizing factor for the Philippines economy has been overseas worker remittances by Filipinos working abroad, which remained quite stable during 2020 despite the COVID-19 pandemic, down only 0.8% y/y, and equivalent to around 10% of GDP. Remittances sent home by workers are an important factor supporting domestic consumer spending in the Philippines. Despite concerns about job losses for workers abroad due to the impact of the pandemic on many industries such as tourism and aviation, remittances data continues to show resilient remittance inflows for 2021. Remittances by workers abroad rose by 5.1% y/y in 2021, to a record high of USD 34.9 billion. In 2022, remittances by workers abroad rose by 3.6% y/y, to USD 36.1 billion.

Rapid growth in exports from the IT-BPO sector have also become an important boost for the Philippines economy and for total exports. IT-BPO exports have risen from USD 9.5 billion in 2010 to USD 25.1 billion by 2021, according to BSP estimates. Total estimated IT-BPO export revenues, consisting of computer and other business services, amounted to USD 27.4 billion in 2022, 9.1 percent higher in 2021.

Philippines Economic Outlook

Despite the impact of the COVID-19 Delta wave in the second half of 2021, GDP growth for calendar 2021 rebounded to 5.6% y/y. Strong growth momentum has continued in 2022, at a pace of over 7.6% y/y. Easing of pandemic-related travel restrictions during 2022 has also allowed a gradual reopening of domestic and international tourism travel. If sustained during 2023, this would provide an important boost to the economy. Prior to the pandemic, in 2019, gross direct tourism value added as a share of GDP was estimated at 12.7% of GDP, including both international and domestic tourism spending. International tourism spending was estimated at Peso 549 billion, while domestic tourism spending was estimated at Peso 3.1 trillion. Due to the importance of domestic tourism in the overall contribution of tourism to GDP, the recovery of domestic tourism could be a significant growth driver in 2023.

The near-term outlook for 2023 is for continued firm economic expansion. The latest S&P Global Philippines Manufacturing PMI survey results for March 2023 continue to signal expansionary conditions for manufacturing output and new orders. Sustained remittance inflows from workers abroad, fast-growing IT-BPO sector exports and the recovery of the tourism sector are also expected to support economic growth momentum during 2023.

According to the IT and Business Process Association of the Philippines, total IT-BPO headcount in the Philippines reached 1.57 million in 2022 with revenues for the sector rising to USD 32.5 billion.

The long-term outlook for the IT-BPO sector in the Philippines is for continued high growth, helped by key competitive advantages of a well-educated workforce and English language proficiency.

Continued rapid GDP growth of around 5.8% y/y is expected in 2023, helped by sustained strong private consumption spending, an upturn in government infrastructure spending and improving remittance inflows.

The Philippines economy is forecast to continue to grow rapidly, with total GDP doubling from USD 400 billion in 2022 to USD 800 billion in 2030. A key growth driver will be rapid growth in private consumption spending, buoyed by strong growth in urban household incomes.

By 2033, the Philippines is forecast to become one of the Asia-Pacific region’s small group of one trillion-dollar economies, joining mainland China, Japan, India, South Korea, Australia, Taiwan and Indonesia in this grouping of the largest economies in APAC. This strong growth in the size of the Philippines economy is also expected to drive rapidly rising per capita GDP, from USD 3,500 in 2022 to USD 6,200 by 2030. This will help to underpin the growth of the Philippines domestic consumer market, catalyzing foreign and domestic investment into many sectors of the Philippines economy.

The Philippines will also benefit from its membership of the recently implemented RCEP (Regional Comprehensive Economic Partnership Agreement) trade deal, particularly due to its very favorable rules of origin treatment, which provide cumulative benefits that will help to build manufacturing supply chains within the RCEP region across different countries. This will help to attract foreign direct investment flows for a wide range of manufacturing and infrastructure projects into the RCEP member nations, particularly into low-cost manufacturing hubs such as the Philippines.

Consequently, the outlook for the Philippines economy over the next decade is very favorable, with significant progress in economic development expected. In 2021, the Family Income and Expenditure Survey of the Philippines government indicated that 20 million people, or around 18.1% of the total population, still live below the poverty threshold. Rapidly rising per capita GDP and standards of living will help to underpin a broad improvement in human development indicators and should deliver a significant reduction in the share of the population living in extreme poverty over the decade ahead.

Source: Dept. of Foreign Affairs and Trade – Australian `Government

RCEP (Regional Comprehensive Economic Partnership Agreement) is a regional free trade agreement that complements and builds upon Australia’s existing free trade agreements with 14 other Indo-Pacific countries.

RCEP entered into force on 1 January 2022 for ten original parties: Australia, Brunei Darussalam, Cambodia, China, Japan, Laos, New Zealand, Singapore, Thailand and Vietnam. RCEP then entered into force for the Republic of Korea on 1 February 2022, for Malaysia on 18 March 2022, for Indonesia on 2 January 2023 and for the Philippines on 2 June 2023. RCEP is the world’s largest free trade agreement by members’ GDP.

RCEP negotiations were launched in November 2012 between the Association of Southeast Asian Nations (ASEAN includes Brunei Darussalam, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam) and ASEAN’s free trade agreement partners (Australia, China, India, Japan, New Zealand and the Republic of Korea). For background on the path to launching RCEP negotiations, refer to Background to the Regional Comprehensive Economic Partnership Agreement (RCEP).

The Philippine Gross Domestic Product (GDP) posted a year-on-year growth of 5.7 percent in the first quarter of 2024. The Economic Outlook projects steady global GDP growth of 3.1% in 2024, the same as the 3.1% in 2023, followed by a slight pick-up to 3.2% in 2025.

1 .2024 World Economy

What is the global economic outlook for 2024? | Global Investment Outlook (youtube.com)

Global Economic Prospects: Spring 2024 (youtube.com)

2. 2024 U.S. Economy

3. Major Country Economies

4. Economic Environment/Risk Factors

5. Business Confidence

6. Fiscal Issues

7. Philippines

a) Recent Situation: Looking Back 2023

b) Outlook Exports

c) Capital Investment

d) Personal Consumption

e) Prices

f) Logistics Issues

g) Emerging Economies

h) ASEAN

1) General View of Main ASEAN Countries

2) GDP/Prices (Inflation)

3) Exports

4) Tourism

5) Monetary Policy

6) GDP, Prices

7) Consumption/Production

8) Monetary Policy

9) Emerging Economy Debt Risk: An Overview

10) Emerging Economy Debt Risk: Philippines

11) Philippines Monetary Policy/Inflation Trends

12) Philippines Economy and Voluntary Oil Production

NOTE:

- This material was created based on publicly and privately available information and as such Minreta Group cannot guarantee the accuracy, correlation, connection, thoroughness or truthfulness of this material.

- Any conclusion or judgement made, or action taken based on the contents of this material is strictly and responsible under the discretion of the user of this material with all outcomes the sole responsibility of the user and not that of Minreta Group.

- The content of this material may be subject to change without prior notification

- All pictures, illustrations, written content, etc. (afterward exactly referered to as “information”) in this material are the sole property (copyright) of Minreta Group, protected under the Copyright Law of the Philippines and the RBC Global Asset Management and Peterson Institute for International Economics, etc. Individual private usage and citation are allowed under the copyright law, however, without the express written permission of the copyright holder the copying, distribution, translation, alteration, adaptation, public transmission and/or preparing to transmit the information I this document will be considered a violation of the copyright law.